tax saving strategies for high income earners canada

The investment income and capital gains generated in the plan are not subject to tax until you make a withdrawal in the future. Our tax receipt scanner app will.

Not All Vehicles Are Created Equal And For High Earners In Particular The Conventional Wisdom May Not Apply Savings Strategy Financial Planning Hierarchy

Top Tax-Saving Strategies for High-Income Earners in Canada.

. The brackets stay at 0 15 and 20 The net investment income tax continues. You dont have to be in the 1 to incorporate these tried and true tax strategies into your own. A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners.

Four tricks the wealthy use to reduce taxes that ordinary Canadians can try too. Max Out Your Retirement Account. Generally unknown to high income earners is the existence of many smart and legal tax-saving strategies in Canada.

The interest on anything else you assume to debt to buy is not. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. In fact if youre earning in excess of 180000 youre taxed at 47 for the privilege.

Keep reading to find out five effective tips that you should be utilizing right now. One is to transfer any savings and investments that produce. We will begin by looking at the tax laws applicable to high-income earners.

Lets start with an overview of tax rules for. Tax-free investment income including interest dividends and capital gains. June 5 2019.

2 From a tax perspective youre better off using cash or savings for these discretionary purchases and then. In fact Bonsai Tax can help. There are several ways for such high earners to retain their personal tax-free allowance of 10000 per year.

Here are some of our favorite income tax reduction strategies for high earners. A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses. No upper age restriction on contributions unlike an Registered Retirement Savings Plan RRSP Make.

According to the ATO youre classified as a higher income earner if you earn over 180000 a year. High-income earners make 170050 per year in gross income or 340100 if married or. The more you make the more taxes play a role in financial decision-making.

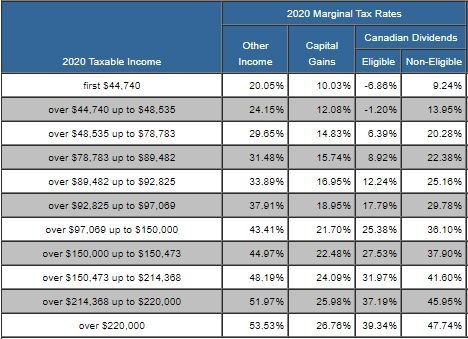

Canadians who earn more than 200000 per year face personal income tax rates upwards of 50 percent. However prior to the 2018 federal budget high earning individuals enjoyed two. Overview of Tax Rules for High-Income Earners.

Structure your investments tax efficiently. Taxes associated with your investments are driven by the types of. Tax Savings Strategies for High Income Earners.

But the tax changes are only temporary and increased the standard deduction for. 3 Tax-Saving Opportunities For High-Income Earners. This bracket applies to single filers with taxable income in excess of 539900 and married couples filing jointly with taxable income in excess of 647850.

A Solo 401k for your business delivers major opportunities for huge tax. You may also want to consider. Make a contribution each year to your RRSP Registered Retirement.

In this post were breaking down five tax-savings strategies that can help you keep more money in. New tax legislation made small reductions to income tax rates for many individual tax brackets.

Go After Top Income Earners With A New Tax Bracket Opposition Urges P E I Government Cbc News

Go After Top Income Earners With A New Tax Bracket Opposition Urges P E I Government Cbc News

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

Ability To Pay Taxation Overview How It Works Example

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Estimating The Net Fiscal Cost Of A Child Tax Credit Expansion Tax Policy And The Economy Vol 36

Annual S P Sector Performance Novel Investor Stock Market Global Indices Marketing

Tax Minimisation Strategies For High Income Earners

Filing Taxes On H1b Visa The Ultimate Guide

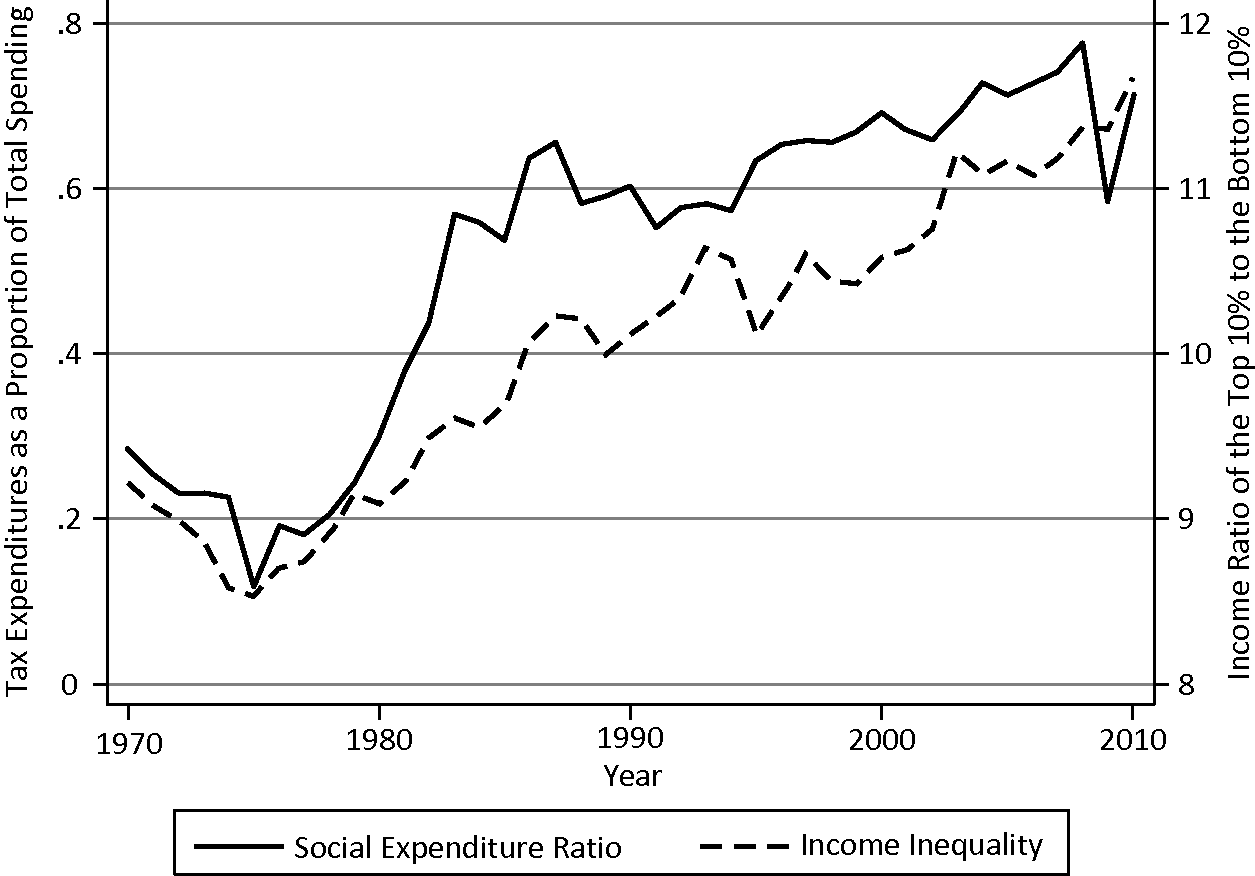

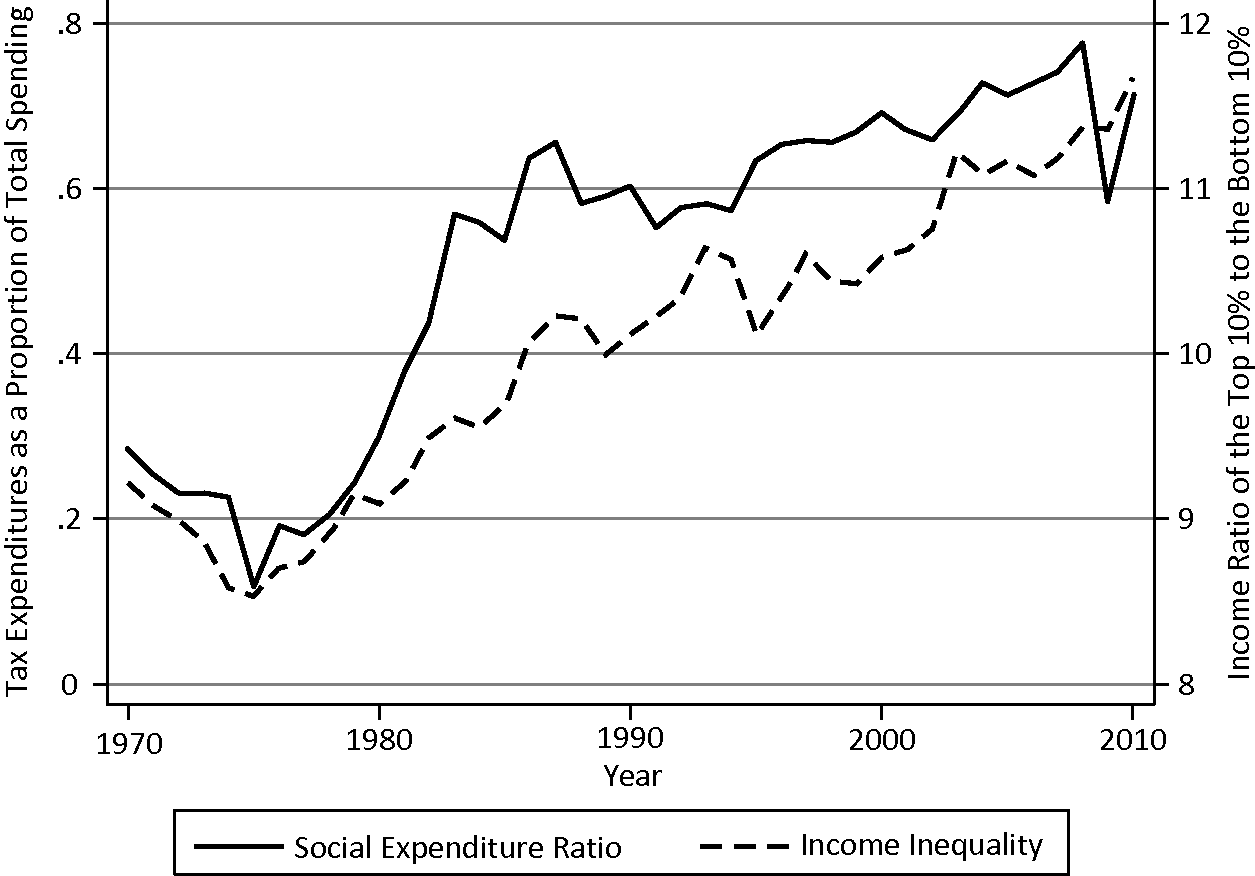

The Modality Of Social Spending And Income Inequality In America Chapter 6 Welfare For The Wealthy